By Mollie Mills April 26, 2025

Credit card transactions have become an integral part of our daily lives, allowing us to make purchases conveniently and securely. But have you ever wondered how these transactions are processed?

In this comprehensive guide, we will delve into the intricacies of credit card transactions processing, exploring the role of credit card networks, the step-by-step authorization process, the clearing process, the settlement process, security measures, different types of credit card transactions, common challenges, and frequently asked questions. By the end of this article, you will have a thorough understanding of how credit card transactions are processed and the various factors involved.

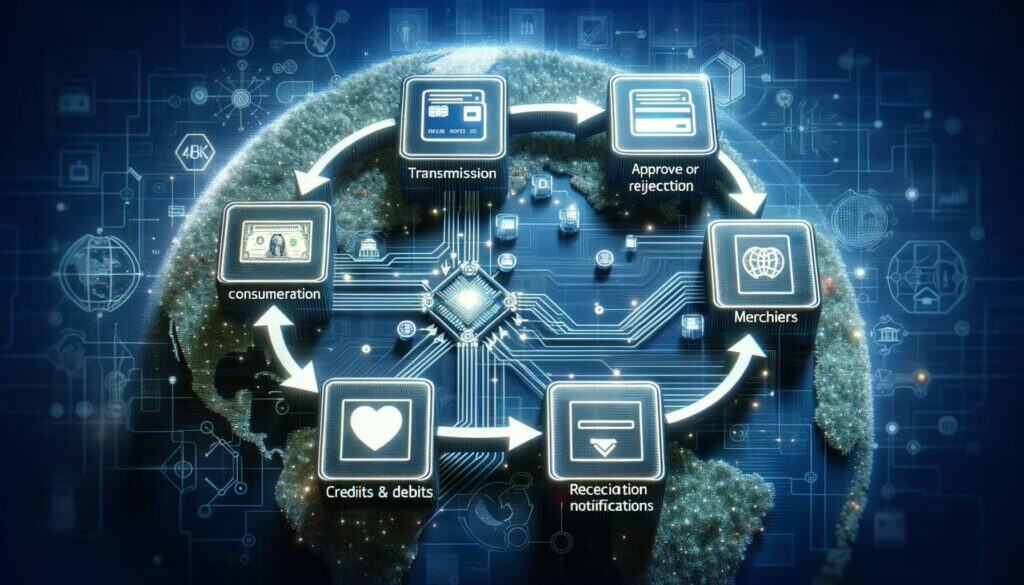

Understanding the Role of Credit Card Networks

Credit card networks play a crucial role in facilitating the smooth processing of credit card transactions. These networks act as intermediaries between the cardholder’s bank (issuing bank) and the merchant’s bank (acquiring bank). The most prominent credit card networks include Visa, Mastercard, American Express, and Discover.

When a credit card transaction is initiated, the cardholder’s information is securely transmitted to the credit card network, which then verifies the transaction and authorizes the payment. The network also ensures that the funds are transferred from the cardholder’s bank to the merchant’s bank.

Step-by-Step Guide: Authorization Process for Credit Card Transactions

The authorization process is a crucial step in credit card transactions processing, as it determines whether a transaction can proceed or not. Let’s take a closer look at the step-by-step guide for the authorization process:

1. Cardholder Initiates Transaction: The cardholder presents their credit card to the merchant and requests to make a purchase.

2. Merchant Sends Authorization Request: The merchant’s point-of-sale (POS) system sends an authorization request to the credit card network, containing the cardholder’s information, transaction amount, and merchant details.

3. Credit Card Network Verifies Cardholder Information: The credit card network receives the authorization request and verifies the cardholder’s information, including the card number, expiration date, and CVV code.

4. Authorization Request Sent to Issuing Bank: Once the cardholder’s information is verified, the credit card network sends the authorization request to the cardholder’s bank (issuing bank).

5. Issuing Bank Approves or Declines Transaction: The issuing bank reviews the authorization request and checks if the cardholder has sufficient funds or credit limit to cover the transaction. Based on this assessment, the issuing bank either approves or declines the transaction.

6. Authorization Response Sent to Merchant: The issuing bank sends an authorization response to the credit card network, indicating whether the transaction is approved or declined. This response is then transmitted back to the merchant’s POS system.

7. Merchant Notifies Cardholder: The merchant’s POS system notifies the cardholder of the authorization response, informing them whether the transaction was successful or not.

Exploring the Clearing Process for Credit Card Transactions

Once a credit card transaction is authorized, it enters the clearing process, which involves the settlement of funds between the cardholder’s bank and the merchant’s bank. Let’s explore the clearing process in more detail:

1. Merchant Sends Clearing Request: After receiving the authorization response, the merchant’s POS system sends a clearing request to the credit card network, indicating the approved transaction.

2. Credit Card Network Initiates Clearing: The credit card network receives the clearing request and initiates the clearing process by debiting the cardholder’s bank account and crediting the merchant’s bank account.

3. Clearing Request Sent to Issuing Bank: The credit card network sends the clearing request to the cardholder’s bank, requesting the transfer of funds to the merchant’s bank.

4. Issuing Bank Transfers Funds: The issuing bank transfers the funds from the cardholder’s account to the merchant’s account, completing the clearing process.

The Settlement Process: Finalizing Credit Card Transactions

The settlement process is the final step in credit card transactions processing, where the funds are settled between the merchant’s bank and the credit card network. Let’s take a closer look at the settlement process:

1. Merchant Sends Settlement Request: Once the clearing process is complete, the merchant’s POS system sends a settlement request to the credit card network, indicating the finalized transaction.

2. Credit Card Network Initiates Settlement: The credit card network receives the settlement request and initiates the settlement process by debiting the merchant’s bank account and crediting the network’s account.

3. Settlement Request Sent to Acquiring Bank: The credit card network sends the settlement request to the merchant’s bank (acquiring bank), requesting the transfer of funds to the network’s account.

4. Acquiring Bank Transfers Funds: The acquiring bank transfers the funds from the merchant’s account to the network’s account, completing the settlement process.

Security Measures in Credit Card Transactions Processing

Credit card transactions processing involves various security measures to protect cardholders’ sensitive information and prevent fraudulent activities. These security measures include:

1. Encryption: Credit card networks and merchants use encryption technology to secure the transmission of cardholder data, ensuring that it cannot be intercepted or accessed by unauthorized individuals.

2. Tokenization: Tokenization is a process where sensitive cardholder data is replaced with a unique identifier (token). This token is used for transaction processing, while the actual cardholder data is securely stored in a separate system.

3. PCI DSS Compliance: Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards that all entities involved in credit card transactions processing must adhere to. It includes requirements for secure network architecture, regular system updates, and protection of cardholder data.

4. Fraud Detection Systems: Credit card networks and merchants employ sophisticated fraud detection systems that analyze transaction patterns and identify suspicious activities. These systems help prevent fraudulent transactions and protect cardholders from unauthorized use of their cards.

Different Types of Credit Card Transactions: Card-Present vs. Card-Not-Present

Credit card transactions can be categorized into two main types: card-present and card-not-present transactions. Let’s explore the differences between these two types:

1. Card-Present Transactions: Card-present transactions occur when the cardholder physically presents their credit card to the merchant for payment. This can be done by swiping the card through a card reader or inserting it into a chip-enabled terminal. Card-present transactions are considered more secure, as the cardholder’s presence provides an additional layer of verification.

2. Card-Not-Present Transactions: Card-not-present transactions occur when the cardholder makes a purchase without physically presenting their credit card. This can be done through online shopping, telephone orders, or mail orders. Card-not-present transactions are considered higher risk, as the cardholder’s identity and card information may be more susceptible to fraud.

Common Challenges in Credit Card Transactions Processing

While credit card transactions processing has become increasingly efficient and secure, there are still some common challenges that merchants and cardholders may encounter. These challenges include:

1. Payment Gateway Issues: Payment gateways are the interfaces that connect merchants’ websites or POS systems to the credit card networks. Technical issues with payment gateways can result in transaction failures or delays.

2. Declined Transactions: Sometimes, legitimate transactions may be declined due to various reasons, such as insufficient funds, exceeded credit limits, or suspected fraudulent activity. These declined transactions can cause inconvenience for both the cardholder and the merchant.

3. Chargebacks: Chargebacks occur when a cardholder disputes a transaction and requests a refund from their issuing bank. Chargebacks can be initiated for various reasons, including unauthorized transactions, goods not received, or dissatisfaction with the purchased product or service. Merchants may face financial losses and additional administrative burdens due to chargebacks.

4. Fraudulent Activities: Despite the security measures in place, credit card transactions processing is still vulnerable to fraudulent activities. Fraudsters may use stolen card information or engage in identity theft to make unauthorized transactions, causing financial losses for both cardholders and merchants.

Frequently Asked Questions (FAQs)

Q1. How long does it take for a credit card transaction to be authorized?

A1. The authorization process typically takes a few seconds, but it can vary depending on factors such as network connectivity, the issuing bank’s response time, and the complexity of the transaction.

Q2. Can a credit card transaction be declined even if I have sufficient funds?

A2. Yes, a transaction can be declined for reasons other than insufficient funds, such as suspected fraudulent activity, exceeded credit limits, or technical issues.

Q3. What is a chargeback, and how does it affect merchants?

A3. A chargeback occurs when a cardholder disputes a transaction and requests a refund from their issuing bank. Merchants may face financial losses and additional administrative burdens due to chargebacks.

Q4. How can merchants protect themselves from fraudulent transactions?

A4. Merchants can implement various security measures, such as using fraud detection systems, adhering to PCI DSS compliance, and verifying cardholder information during the transaction process.

Conclusion

Credit card transactions processing involves a complex series of steps, from authorization to clearing and settlement. Credit card networks play a crucial role in facilitating these transactions, ensuring the secure transfer of funds between cardholders and merchants. Security measures, such as encryption, tokenization, and fraud detection systems, are implemented to protect cardholders’ sensitive information and prevent fraudulent activities.

Different types of credit card transactions, such as card-present and card-not-present, have their own unique considerations and risks. While challenges such as payment gateway issues, declined transactions, chargebacks, and fraudulent activities exist, continuous advancements in technology and security measures aim to enhance the efficiency and security of credit card transactions processing.